What is Osmosis?

Osmosis is the premier cross-chain DeFi hub. As the liquidity center and primary trading venue of Cosmos – the open, emergent ecosystem of sovereign Layer 1s connected with the Inter-Blockchain Communication protocol (IBC) – it is the access point for the wide world of appchains, the gateway to the interchain. As IBC continues to explode – with more than 50 blockchains connected and dozens more in development, including dYdX chain, and with teams working to enable IBC on Avalanche, Polkadot, NEAR, and others, potentially even Ethereum – Osmosis will be there to welcome new users, developers, and protocols to the Internet of Blockchains.

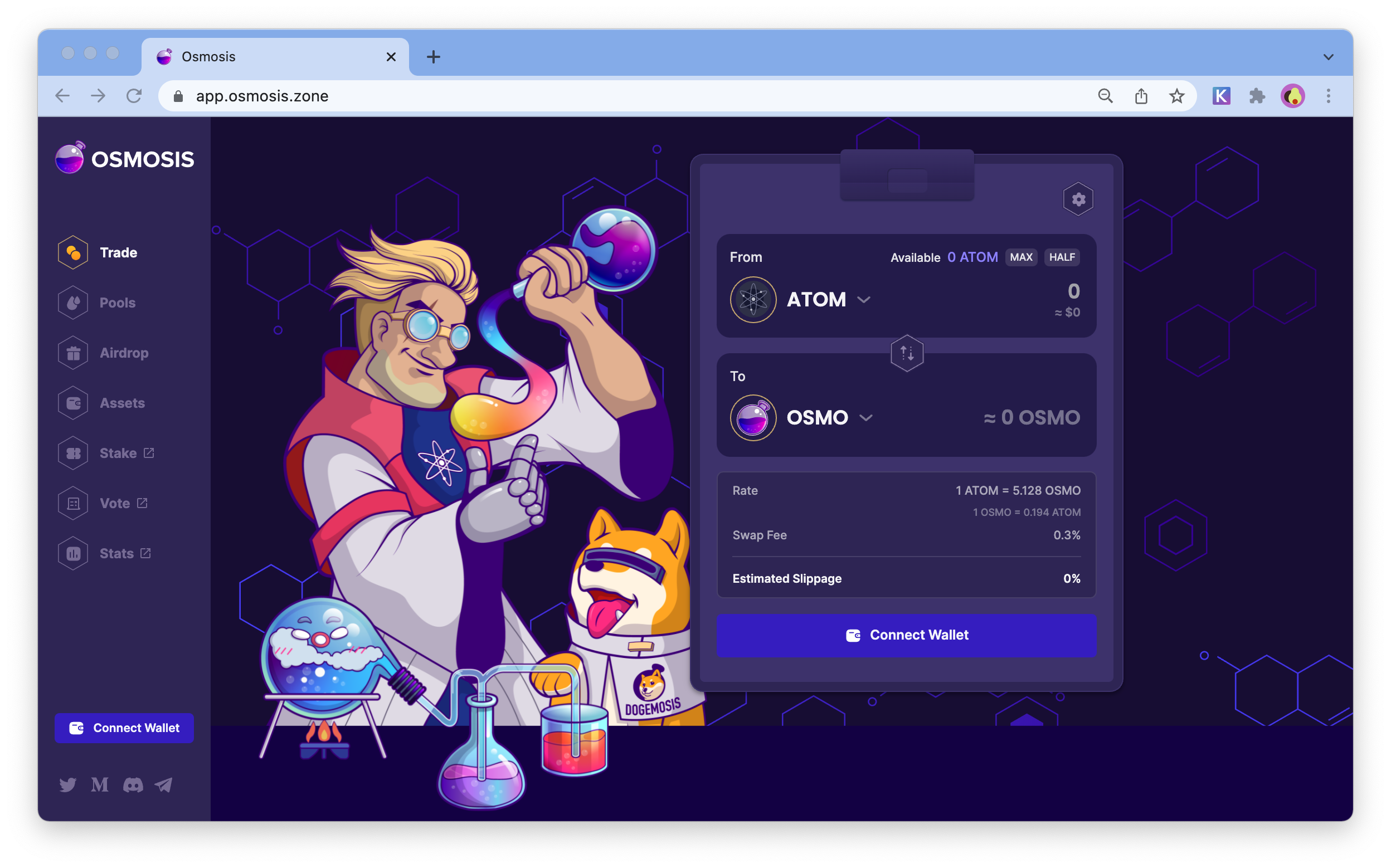

The Osmosis Ecosystem is a suite of premier, DAO-gated dApps that are tightly integrated into the Osmosis AMMs and IBC routing capabilities. Dozens of developer teams are building index tokens, options, perps, stops and limit orders, automated trading, yield vaults, NFTs, and more. With new apps and features like stableswap, concentrated liquidity, rate-limiting, in-protocol MEV capture, and more going live all the time, Osmosis is continuing to expand its moat as the only full-service, cross-chain exchange and DeFi hub, one that rivals the smooth user experience of a CEX without compromising on the benefits of decentralized finance – self-custody, trust-minimized transactions, direct on-chain access, and privacy.

Why Osmosis?

On customizability of liquidity pools

Most major AMMs limit the changeable parameters of liquidity pools. For example, Uniswap only allows the creation of a two-token pool of equal ratio with the swap fee of 0.3%. The simplicity of Uniswap protocol allowed quick onboarding of the average user that previously had little to no experience in market making.

However, as the DeFi market size grows and market participants such as arbitrageurs and liquidity providers mature, the need for liquidity pools to react to market conditions becomes apparent. The optimal swap fee for a AMM trade may depend on various factors such as block times, slippage, transaction fee, market volatility and more. There is no one-size-fits-all solution as the mix of characteristics of blockchain protocol, tokens in the liquidity pool, market conditions, and others can change the optimal strategy for the liquidity providers and the market makers to carry out.

The tools Osmosis provides allow the market participants to self-identify opportunities and allow them to react by adjusting the various parameters. An optimal equilibrium between fee and liquidity can be reached through autonomous experiments and iterations, rather than setting a centrally planned 'most acceptable compromise' value. This extends the addressable market for AMMs and bonding curves beyond simple token swaps, as a limitation on the customizability of liquidity pools may have been the inhibiting factor for more experimental use-cases of AMMs.

AMM as serviced infrastructure

The number and complexity of decentralized financial products are consistently increasing. Instruments such as pegged assets, derivatives, options, and tokenized leveraged positions each have their own characteristics that produce optimal market efficiency when paired with the correct bonding curve. That being said, the traditional notion of AMMs have evolved around putting the AMM first, and the financial product being traded second.

As AMMs substantially increase the market accessibility for these instruments, assets with diverse characteristics either had to:

- Compromise efficiency and trade on existing AMMs with non-optimal bonding curves or

- Take on the massive task of building one's own AMM that is able to maximize efficiency

To solve this issue, Osmosis introduces the idea of an 'AMM as a serviced infrastructure'. Fairly often, adjustment of the value function and a few additional parameters are all that's needed to provide a highly-efficient, highly-accessible AMM for the majority of decentralized financial instruments. By providing the ability for the creator of the pool to simply define the bonding curve value function and reuse the majority of the key AMM infrastructure, the barrier to creating a tailor-made and efficient automated market maker can be reduced.